Coronavirus – Predictably, the Markets React

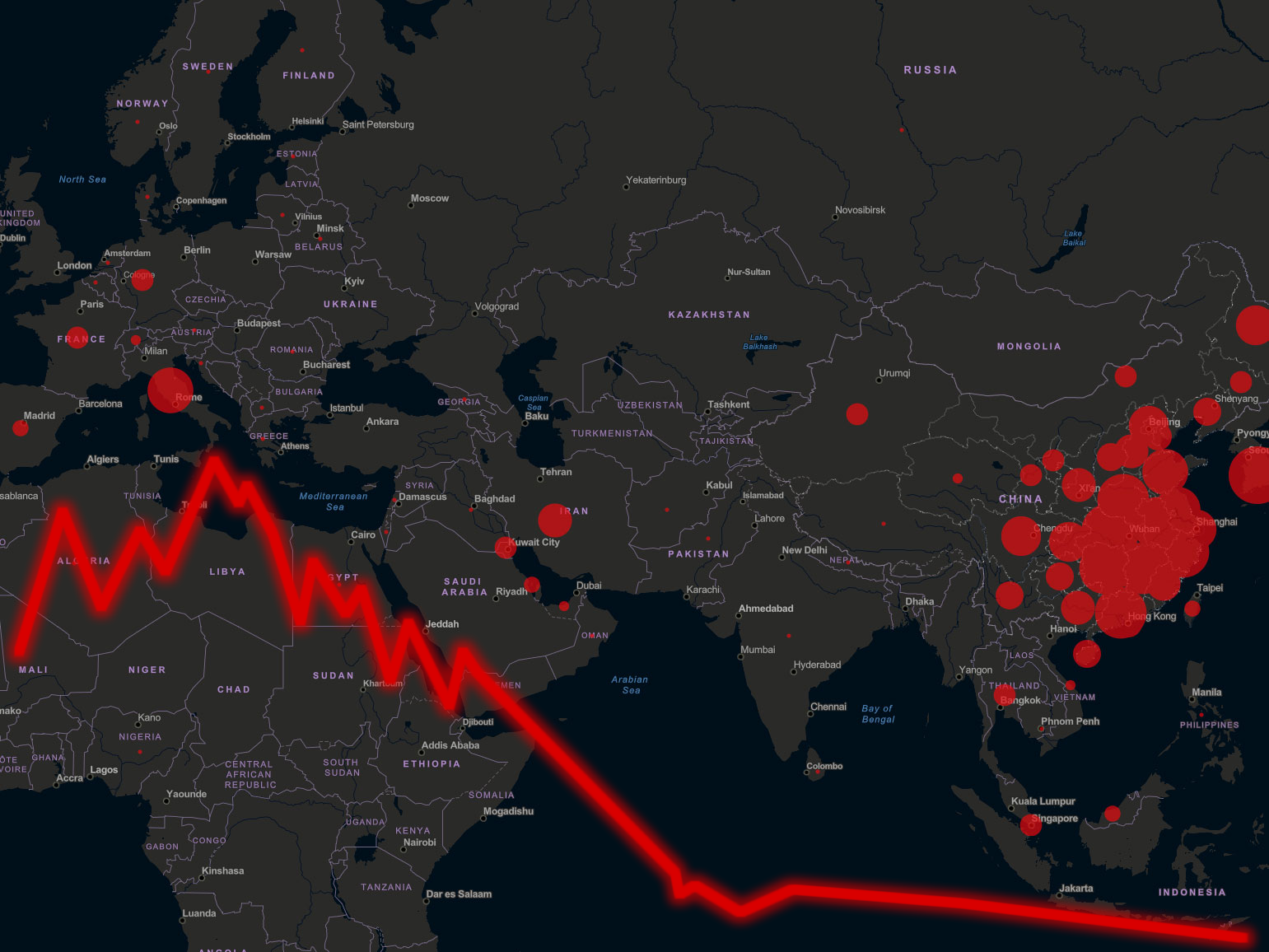

Over the last few days we have falls in equity prices around the world, and some less dramatic rises in the prices of traditional safe havens such as gold. This is the usual market behaviour to a perceived global crisis, but it is important to put this in perspective with a longer term view.

2019 was a remarkably good year for equity investors particularly in the last quarter of the year. It could be argued there was already scope for a downward adjustment, and that the coronavirus threat has prompted this in a dramatic fashion. One thing history has taught us is that when stock markets spike one way there will be an equally dramatic reversal at some stage.

In a sense, if an official pandemic emerges this is almost irrelevant. It is confidence that drives markets and the world’s ability to manage crises so that wealth creation can continue. Historically wealth creation has always won through, although predicting the when and where is of course impossible.

In our view, we can expect a lot of short term high volatility as this pans out. However we view the long term positively. The fundamentals have not changed – the less affluent still way outnumber the affluent on this planet. That is a powerful driving force to continue to create wealth by overcoming the inevitable hurdles that present themselves over time.